Classic paper worksheet made up of static lines that many cross-eyed accountants and bookkeepers of old have grown to hate.

*Originally published in my Medium blog.

I’m an accountant by profession. Not necessarily by choice. I love words more than numbers so I’m a copywriter by heart. I write stuff for clients and I’ve been at it for the past 13 years.

This is the reason why I feel it’s been several lifetimes since I’ve last used a columnar book or worksheet. By that I mean actual paper filled with crisscrossing lines. They’re really bad for the eyes, especially because you can’t zoom in or increase the font sizes in them—unless you’re carrying a magnifying glass.

I wonder, are columnar pads or notebooks even available anymore? I really have no idea.

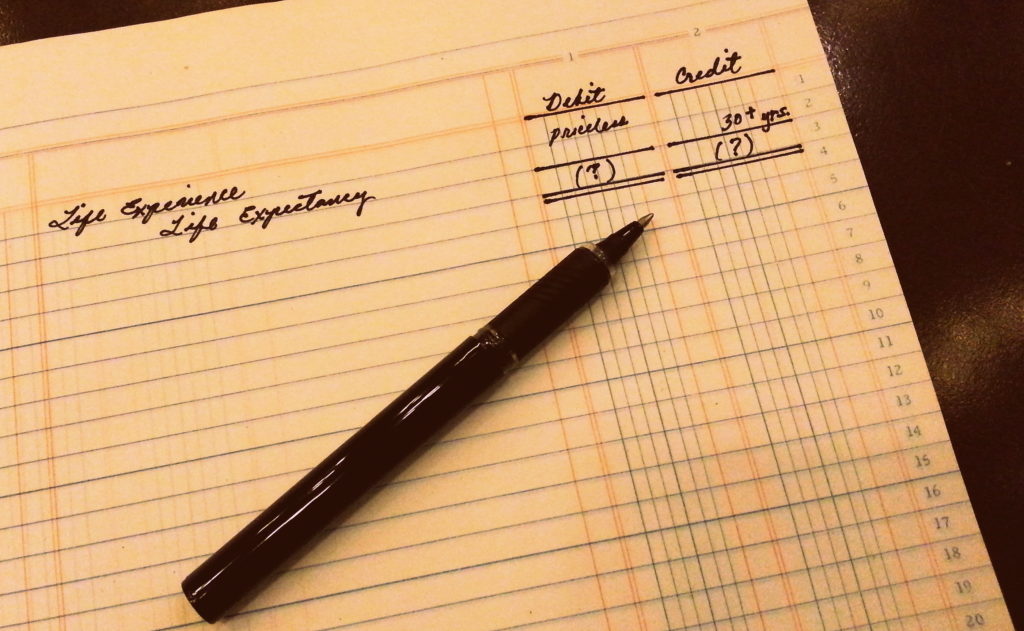

But paper worksheets are not the reason why I’m suddenly feeling nostalgic about my days as an accountant. I’m writing these lines because I’m reminded of the one thing about accounting that really touches on life in general. You don’t have to be an accountant or an accountancy student to see the value of this one little concept.

I’m talking about the double-entry method or debit-credit system.

The method requires that for every debit item you make, there must be a corresponding credit item. Or as my beloved professor put it: “The value received is always equal to the value parted with.”

If you fail to balance your debits and credits, your accounting books are going to be in trouble. When that happens, you’re going to have long nights or, worse, forfeited weekends. Unless of course you know how to cook, if you know what I mean.

Brief History of the Double-Entry Method

The modern double-entry accounting system traces its roots from a Franciscan friar named Luca Pacioli. He described the method in detail in a book he published in 1494. By the way, the old friar was also friends with Leonardo da Vinci. And that says a lot about someone’s personality.

Even so, Pacioli isn’t the first one to come up with the system. Historians claim that a double-entry method of accounting and record-keeping had been used in the Middle East as early as 634-644 CE.

In Europe, the system is believed to have been used as far back as the 14th century. Accounting journals dating back to 1340 have been found in the old treasurer’s office in Genoa. They had debit and credit entries in them.

In short, even before Pacioli published his book, merchants and bankers in bustling commercial places like Genoa, Venice, and Florence had widely used the double-entry accounting system.

Rewards and Sacrifices

The debit-credit method has a more profound meaning beyond numbers and totals. The Olympic Games, for instance, highlights the power of the system outside of paper worksheets or Excel files. Or SAP. Or Sage. Whatever.

In any of the events, the athletes who win the medals (debit item or value received) can be reasonably expected to have put in or spent hundreds, if not thousands, of hours for practice (credit or value parted with).

They have sacrificed time and energy which they could have spent with their families or in front of TV screens doing marathons of the Netflix-kind.

The same is true in your career. If you give your best performance, soon enough you’ll “debit” a well-deserved promotion.

Universal Law of Justice

Even the wheels of universal justice pretty much run on the double-entry method. In essence, the debit-credit method follows the concept of Karma.

For example, the guy in the Camaro who just cut you off may be thinking that he just debited (value received) a few seconds of getting ahead of other motorists on the road.

He’s unaware that he just parted away with his and other people’s safety. If his recklessness caused him to run over someone on the pedestrian crossing or—gasp!—resulted in a pileup five cars deep, then he may as well “credit” his liberty. Or life.

The System Works Both Ways

The debit-credit system is present in all aspects of life. But it’s not just about success or having a rose-colored view of one’s existence.

Just because you debit something doesn’t necessarily mean it’s good for you. After all, expense accounts are normally entered on the debit side of the worksheet. And people normally want to avoid expenses.

Take the case of the woman who just ordered a venti Frappuccino with five pumps of syrup plus whipped cream. Debit: sugar and calories. Credit: health.

In the same way, just because something is credited doesn’t mean it’s a bad thing. Income or revenue accounts are credit entries. And I have yet to meet someone who hates income.

I can’t really think of a good example on this one right now. But knowing that owner’s equity has a normal balance on the credit side, here’s a shot at it. Having good friends helps you improve your overall well-being, which is just like owner’s equity. So debit: good friends. Credit: Improved well-being. Or something like that.

Balancing the debit and credit sides is what’s truly important. It’s all about balancing the scales.

The point in all this is that everything has consequences, for better or for worse.

If you messed up your debit and credit accounts, you won’t have a balanced Balance Sheet and your Income Statement won’t truly reflect your business performance for the period.

In Summary

The double-entry method is the most basic concept in accounting. It’s the very first thing a student learns in Accounting 101. Having a deep understanding of the system kept me through my BS Accountancy days in college. And it kept me through the rigorous CPA board exams after I graduated.

Today, I may not be in the accounting field anymore, but the concept helps me get a handle on life in general. I just hope, I’d get more earnings per share out of it, but that’s another story entirely.

Always remember, debit equals credit. You get what you give. You reap what you sow.